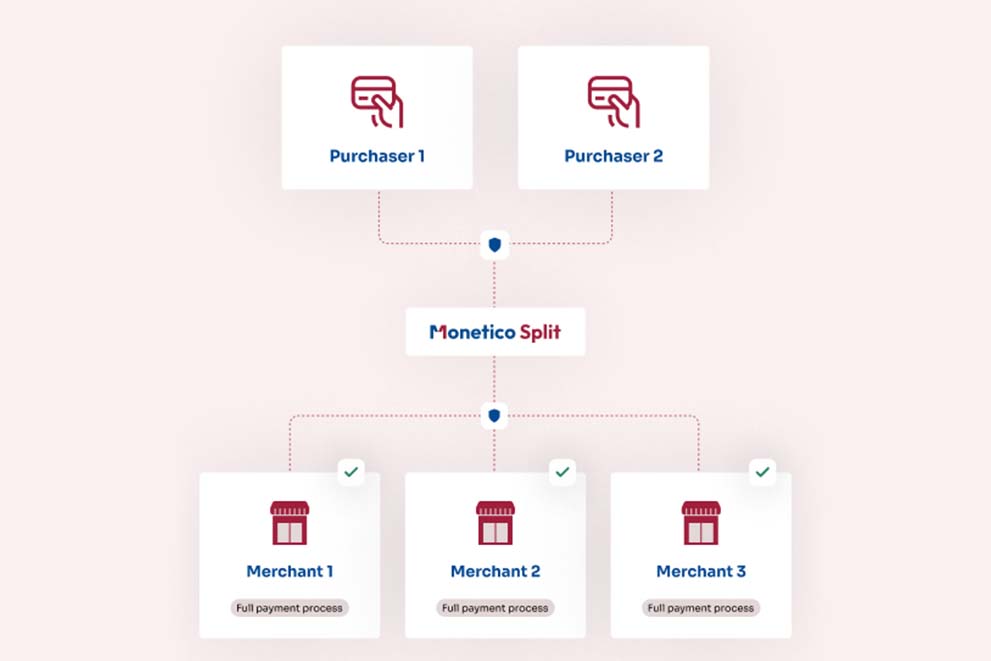

The payment collection solution

The strengths of Monetico Split

Banking and payment expertise

Our expertise in the field of payments inherited from Crédit Mutuel and CIC gives us the ability to adapt to your needs. Monetico Split ensures the security of transactions on behalf of third parties, for all stakeholders.

Our expertise in the banking field is at your service.

A solution made in France

Monetico Split is a 100% French solution offered by Crédit Mutuel and CIC.

Benefit from the durability and solidity of these long-standing companies in the banking sector, thus ensuring the security of your payment transactions.

Dedicated and responsive teams

The Monetico Split team is fully involved in your success.

That's why you have access to specific support, wherever you are.

A robust and easy-to-implement API1

Easy integration, APIs with the latest security standards: many features are implemented to make your job easier.

Pricing transparency

In the sometimes opaque and regulated world of collection of funds on behalf of third parties, at Monetico Split we prefer transparency: costs are displayed and payments are simplified.

Full support for greater peace of mind

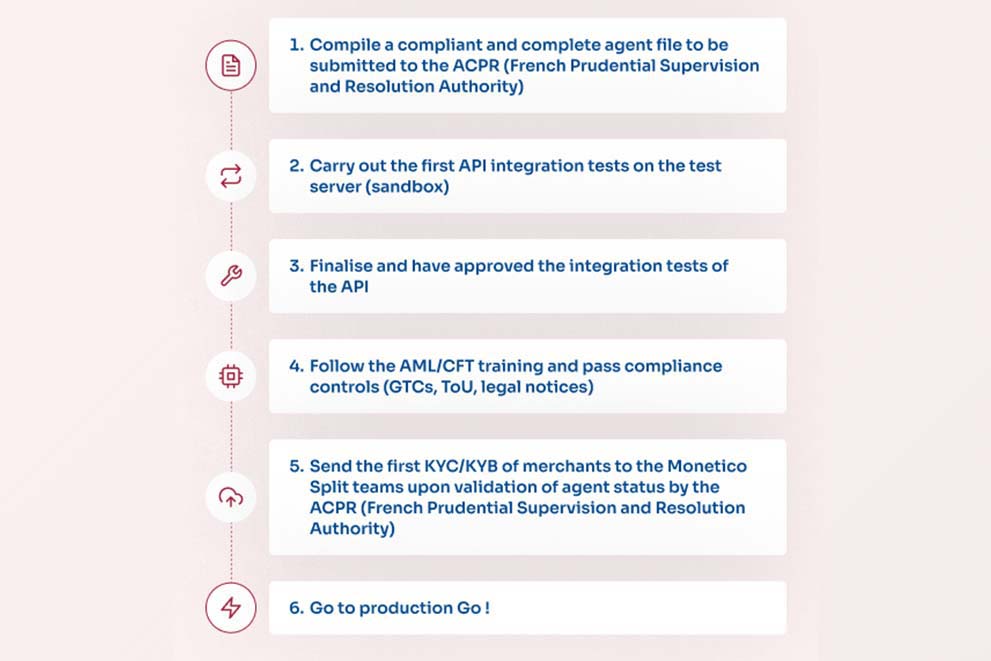

Avoid long and expensive procedures.

Monetico Split manages all compliance with French regulations, allowing you to focus fully on your business and your objectives.

What is the role of an agent of a payment institution?

A payment institution agent has several responsibilities:

- It must manage the Monetico Split payment service contract and control the merchant's activity.

- It collects documents relating to KYC2 from merchants.

- It has a duty of good repute and competence and must present themselves as an agent (Article L.523-1 of the Monetary and Financial Code).

You thus achieve significant savings in time and resources, increasing your operational efficiency.

To find out all about agent statusWhat are the benefits of an agent?

- Reliability : awareness of AML/CFT risks (flow control, KYC, flow audits, anti-fraud control).

- Security : backed by the payment institution: in accordance with DSP23 and the Monetary and Financial Code.

- Sustainability : a single application for status to be made.

Time-saving and peace of mind

Monetico Split simplifies your financial management and allows you to focus on your growth.

- Technical, administrative and functional time-saving.

- Complete automation of the payment chain.

- Focus on growing your business.

- Compliance over time, peace of mind with regard to French regulations and the French Monetary and Financial Code.

- Optimising transaction processing costs.

- Simplified management of your customers' payments.

Result: a facilitated commercial activity with better performance.

Read moreDedicated teams, at your side

Support and proximity

Choosing Monetico Split means choosing complete support:

- Personalised and local support.

- A team of experts and resources dedicated to the implementation and monitoring of each project.

- Support for the constitution of the agent file and the technical implementation of the solution.

- Field knowledge of teams.

Involvement and total availability

Our teams support you anywhere and at any time. Motivated, committed and contactable on a daily basis, they make sure to offer you the most secure and reliable solutions..

Our telephone support is available 5 days a week from 9 a.m. to 6 p.m. Monetico Split makes every effort to ensure your success.

Contact us