A secure and controlled environment

Benefit from the services of an approved EP1

Benefit from an agent status giving you the legal capacity to operate on the national territory and to integrate new merchants throughout Europe, while respecting the necessary regulatory (PSD22) and prudential requirements.

This approval ensures compliance for the activities of receipt of funds on behalf of third parties, in complete security and compliance with French regulations.

A solution compliant with the latest standards and the highest security standards

- Bank data encrypted and protected by the PCI-DSS3 protocol as soon as the card information is entered.

- Strong authentication procedures for payers thanks to 3DSv2, but also the possibility of frictionless payment.

- Payment data processed and stored in France, thanks to our technological subsidiary Euro-Information.

The Monetico Split portal

A single portal

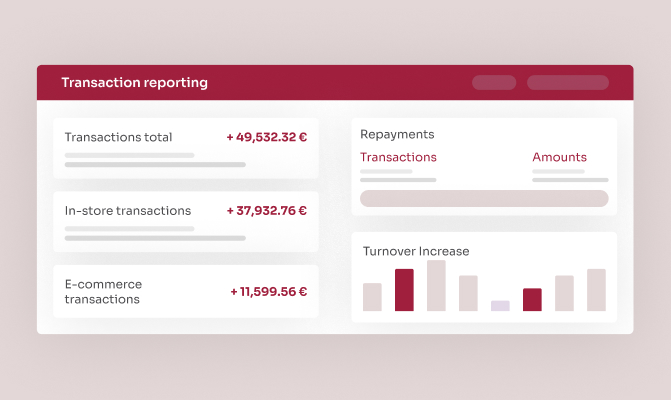

With the Monetico Split portal, you have access to real-time performance monitoring. It facilitates the management of your account and the analysis of transactions, with an overall view of operations.

The portal allows you to view, extract and act on financial flows manually.

Control and management of your activity

- Visualisation of your business and your payments in real time.

- Creation of reporting and export of data.

- Managing your secure access.

- Breakdown of flows to merchants, automatic and manual if necessary.

- Transaction monitoring and notification of alerts.

- Centralised and secure management of receipts and redistribution.

- Transaction log generation.

- Data extraction allowing you to feed your information system and to feed a rich and deep database in accordance with GDPR regulations4.

The strength and security of our API5

A complete and robust API

- A single point of implementation and interfacing of all payment methods.

- A guarantee of security in data exchanges, thanks to the customer certificate and an "API Key" to authenticate you.

- Ease of integration.

- An API that meets the latest security standards.

- A wealth of payment and management methods.

Dedicated support

- Technical and integration documentation provided to your IT teams during the implementation of the API.

- Technical support based in France, always available by email and phone.

- For your developers: a specifically dedicated sandbox6 and a swagger7 available to carry out all your tests and recipes.

- The sandbox benefits from all product developments and is made available before all developments go into production.

The fight against fraud

A reduced risk

Our solution allows you to fine-tune the management of transaction and fraud security. Thanks to our support of Crédit Mutuel and the CIC, we benefit from their experiences and their highly secure tools to support you on the management of fraud.

Support in the AML/CFT8 and in the fight against fraud

We supervise the transactional activity of your platform and trace the origin of flows from the buyer to the seller.

The traceability of flows brings total control of the process and makes it possible to intervene quickly. Our algorithms control the path and breakdown of each transaction in order to identify fraudulent behaviour.

We check each merchant's KYC9 before activating their payment account.